The economic and commercial impact of mobile money

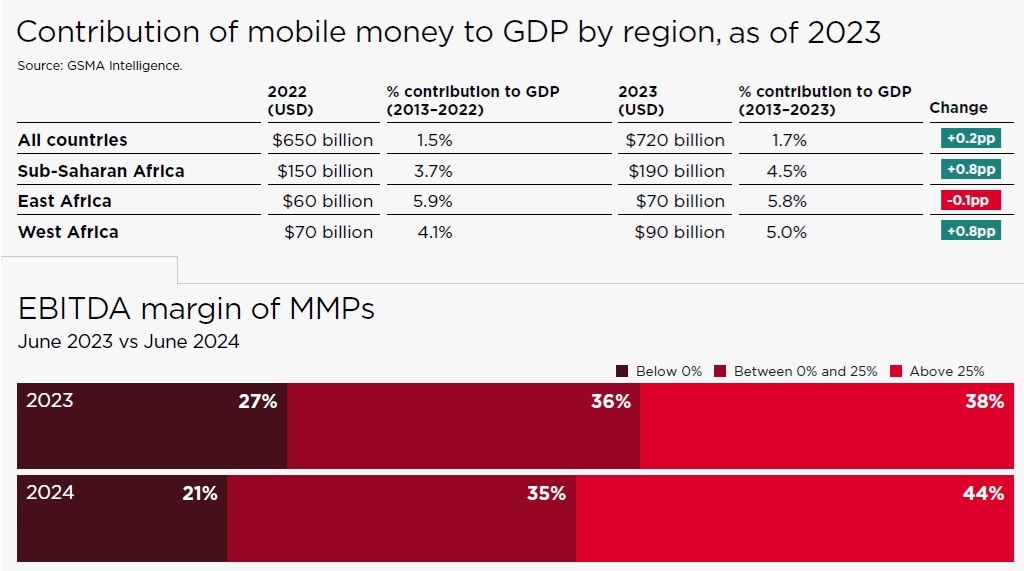

As mobile money continues to permeate the financial lives of millions, its economic and commercial impact is becoming undeniable. Payments Cards & Mobile recently reported on the surge of accounts past the 2 billion mark – now we turn our attention to the economic impact. According to the GSMA State of the Industry Report on […]

The economic and commercial impact of mobile money Read More »